Do We Need to Be Registered in All 50 States to Offer Charitable Gift Annuities (CGAs)?

Charitable gift annuities (CGAs) are one of the most compelling life income gift options available for nonprofits and fundraisers. They provide a way for donors to support their favorite causes while also securing a steady income for life, making them an attractive option for both donors and organizations. However, as the popularity of CGAs grows, many nonprofit professionals have one pressing question:

Do we really need to be registered in all 50 states to offer CGAs?

The short answer is no. But as with most things, the nuances matter. Understanding what’s legally required and where your organization must focus its efforts is critical to maintaining compliance and building a successful CGA program.

What Are the Legal Requirements for Offering CGAs?

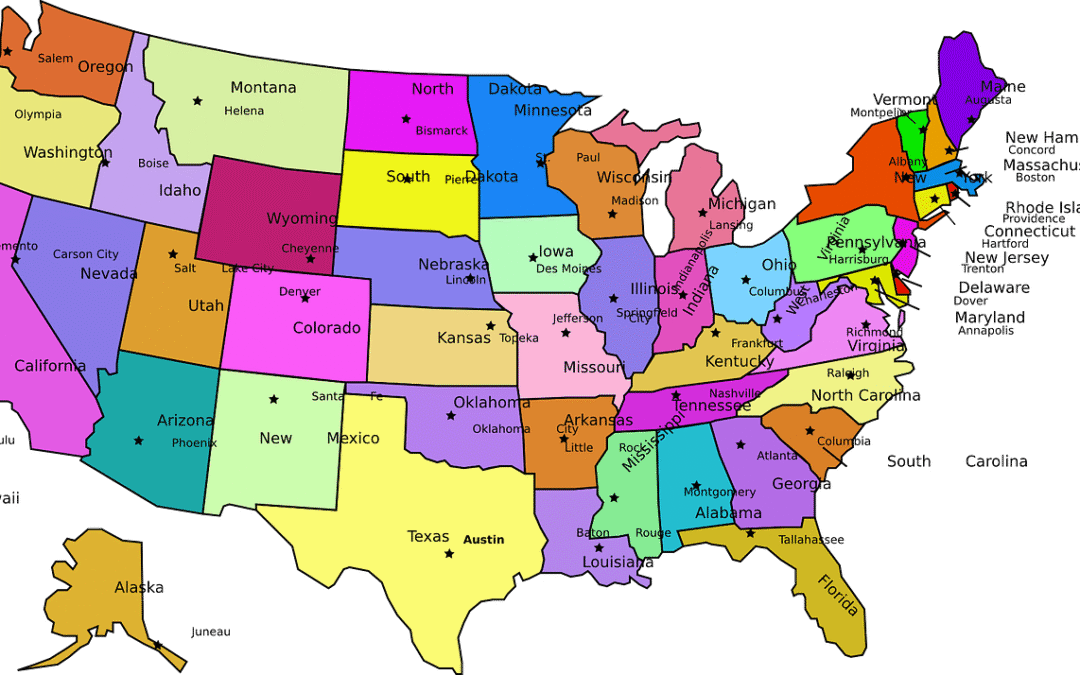

When it comes to offering charitable gift annuities, regulations vary significantly by state. Some states require nonprofits to register or obtain specific licensing to offer CGAs, while others have no such requirements. Here’s a quick breakdown:

- Registration Required States

Many states require nonprofits to formally register before offering CGAs to residents. These states often mandate strict compliance measures, such as maintaining a reserve fund or providing annual financial reports. For example:

- California requires nonprofits to meet specific reserve requirements and provide filings to the Department of Insurance.

- New York has stringent regulations, including reserving a portion of assets to back annuity agreements and securing a license to issue CGAs.

- Exemption States

A handful of states exempt nonprofits from registering for CGAs, typically if they meet certain conditions, such as being a 501(c)(3) organization with no ongoing operations within the state.

- No Registration Required States

Some states, like Indiana and Montana, do not require nonprofits to register or notify the state to issue CGAs to residents.

Key Takeaway

You don’t need to register in all 50 states to offer CGAs, but you do need to understand the specific rules for the states where your donors reside.

How to Determine Where to Register

Start by reviewing where your donors live or where you anticipate the most interest in CGAs. If your donor base is concentrated in a few states, focus on registering in those states first. However, if your donor pool spans multiple states, here are some actionable steps to ensure compliance:

- Research State Regulations

Visit your state’s charitable solicitation office or Department of Insurance website to understand its requirements. For heavily regulated states, such as California, New York, or New Jersey, you may need to allocate more time and resources.

- Work With Legal or Compliance Experts

If you’re unsure about the specific regulations, consult with a legal expert who specializes in nonprofits or charitable giving. They can offer guidance on navigating the complexities of state laws.

- Develop a Donor-Centric Communication Plan

Be transparent with your donors if regulations in their state limit your ability to offer CGAs. Consider alternative ways they can support your cause with other types of life income gifts.

Why State-by-State Registration Matters

Adhering to state regulations isn’t just about avoiding fines or legal consequences; it’s about building trust with your donors. Operating in compliance demonstrates that you value transparency and accountability, which are key drivers for sustaining donor relationships and growing your CGA program.

Additionally, remaining compliant can help safeguard your nonprofit’s financial health. Some states impose heavy penalties for non-compliance, and the reputational risk of failing to meet legal obligations can harm donor confidence.

Alternatives to Consider If Registration Feels Overwhelming

For nonprofits that may not have the resources to register in multiple states, consider these alternatives:

- Partner with a charity that is already licensed to offer CGAs in those states. These collaborations allow you to expand your reach without taking on the administrative burden of multi-state registration. Check out https://charitablesolutionsllc.com/.

- Explore other life income gifts, such as charitable remainder trusts (CRTs) or donor-advised funds (DAFs), which may offer fewer regulatory requirements while still engaging donors who value planned giving.

- Limit your CGA offerings to states where your organization is already registered or exempt to reduce compliance headaches.

Streamline Your Fundraising Success

Charitable gift annuities are an incredible tool for engaging donors and securing long-term support for your nonprofit’s mission. While navigating state regulations can feel daunting, focusing on compliance in key donor states can help you launch a successful program without overextending your resources.

Want to learn more? Reach out to our team today for tailored guidance on launching or refining your CGA program. We’re here to help ensure your organization’s success while maintaining full compliance with state laws.

With the right strategy and resources, your nonprofit can leverage CGAs to build stronger relationships, provide value to your donors, and amplify your fundraising impact

For fundraisers, educating donors about tax-efficient giving strategies is an essential part of securing and maximizing their support. Among the many strategies, funding a Charitable Gift Annuity (CGA) with a Required Minimum Distribution (RMD) from an IRA is an increasingly popular topic, especially for donors age 70½ and older who want to make a meaningful impact while also addressing their tax obligations.

But is it truly worth it? And how do you guide your donors in making this decision? Let’s break down how the process works, the benefits, and whether it aligns with donor goals.

How Does Funding a CGA with an RMD Work?

For donors with a traditional IRA, the IRS requires individuals to take annual Required Minimum Distributions (RMDs) starting at age 73 (or age 70½ for Qualified Charitable Distributions, QCDs). These RMDs are often a taxable event, which can lead to an increase in a donor’s income taxes.

However, there’s a charitable strategy worth exploring. A donor can use their RMD to fund a CGA—a giving vehicle that benefits the donor as well as the charity. Here’s how it works:

- The donor uses their RMD (via a QCD) to fund a CGA.

- The CGA provides the donor (or a designated beneficiary) with steady, fixed payments for life.

- The remainder of the CGA is donated to the charity of the donor’s choice.

This creates a win-win scenario for the donor and your organization.

Why Would Donors Consider This Strategy?

The real question fundraisers need to address when discussing this approach is whether it meets the donor’s financial and philanthropic goals. Here’s why many donors are drawn to the RMD-to-CGA approach:

- Tax Benefits

By funding a CGA with a QCD, donors can transfer up to $100,000 of their RMD (per year) directly to charity tax-free. This not only helps satisfy their RMD obligation but also avoids the tax burden associated with the withdrawal.

- Lifetime Income

A CGA offers predictable, fixed payments for life. For many older donors, this appeals to their desire for financial stability in retirement while still supporting causes they care about.

- Impactful Giving

Donors find comfort in knowing that after they receive their lifetime payments, the remainder of the CGA will support your mission, leaving a lasting legacy.

- Simplified Planning

For donors trying to balance philanthropic interests with income needs and tax strategies, combining an RMD with a CGA creates a simple yet effective path to achieving multiple goals.

What Are the Potential Limitations?

It’s important for fundraisers to emphasize that, while this strategy holds significant advantages, it’s not for everyone. Some considerations include:

- Minimum Age Requirements: QCDs for funding a CGA are only available to donors 70½ or older.

- Payment Rates & Inflation: CGA payout rates are fixed, meaning they won’t adjust for inflation. Donors will need to ensure this aligns with their income goals.

- Charitable Intent: This strategy is most attractive to donors with a strong desire to leave a meaningful impact on charity. It may not appeal to donors more focused on maximizing financial returns.

Is It Worth It?

The worth of funding a CGA with an RMD lies in the alignment between the donor’s personal goals and the benefits this strategy offers. Here’s a breakdown of when this approach might be especially suitable:

- For the Tax-Conscious Donor: If the donor is concerned about a large tax bill from their RMDs, the QCD-to-CGA strategy can eliminate the taxable income while still satisfying the RMD requirements.

- For the Legacy-Minded Donor: Donors who want to include charitable giving as part of their estate planning will find this strategy particularly appealing.

- For the ‘Mission Driven’ Donor: When donors are passionate about supporting your mission and are financially stable, a CGA can provide peace of mind while aligning tax and giving goals.

How to Discuss This with Your Donors

When introducing this strategy to donors, focus on clear communication and personalized discussions. Here’s how:

- Educate with Simplicity: Use visuals and clear language to explain how RMDs, QCDs, and CGAs work together.

- Highlight Flexibility: Explain how this strategy can complement their retirement plan alongside other tools like outright gifts or donor-advised funds.

- Share Examples: Use case studies to demonstrate real-world benefits. For instance:

> “A long-time donor wanted to support our scholarship fund and was facing a hefty tax bill from her $50,000 RMD. She directed the amount to create a CGA, eliminated the tax burden, received an annual income for retirement, and left a significant legacy for students.”

- Leverage Tools: Provide them with free resources, such as a CGA calculator or personalized gift illustrations, to show how the numbers work.

Closing the Conversation with a Call to Action

For fundraisers, the goal isn’t just about closing a gift; it’s about empowering donors to make informed, meaningful decisions. End conversations with next steps:

- “If you’d like, I can provide a personalized illustration to show how this could work for you.”

- “Would you like to schedule a meeting with our gift planning team to discuss your options further?”

- “Click here to access our free guide on using RMDs to fund charitable gifts.”

By focusing on education and donor-specific benefits, you’re not just raising funds but building relationships and trust.

Final Thoughts

Funding a CGA with an RMD offers a creative and impactful way for donors to balance tax efficiency, financial security, and generous giving. It’s more than a strategy; it’s an opportunity to help your donors create a legacy while empowering your organization’s mission.

Are you ready to guide your donors through this process? If you’d like to explore how to work RMD-to-CGA funding strategies into your fundraising plan, contact us for a free consultation or download our curated guide today!

Building a solid endowment fund is one of the most effective ways to secure your nonprofit’s long-term future. A strong endowment provides financial stability, ensures sustainability, and offers peace of mind that your mission can continue for years to come, even through challenging economic times. But how do you grow your endowment fund effectively?

This blog outlines the best strategies to help fundraisers and charities maximize their endowment-building efforts. Whether you’re new to endowment fundraising or looking for fresh ideas, you’ll find valuable insights here.

What is an Endowment Fund? Why Does It Matter?

An endowment fund is a financial asset designed to provide a stable income stream. These funds are invested, and only a portion of the earnings are used annually, allowing the principal to grow over time. For nonprofits, an endowment can help:

- Cover operational expenses during lean seasons

- Safeguard your mission against unexpected downturns

- Provide funding for future projects without always relying on external donations

Many successful nonprofits, including educational institutions and hospitals, rely heavily on their endowment funds to provide consistent income and secure their futures. It’s a long-term financial strategy that builds confidence with donors by assuring them their gifts will make a lasting impact.

- Define Your Case for Support

The first step in building your endowment is answering one crucial question for donors: Why should they help build your endowment fund rather than contribute to a specific campaign?

Clearly communicate:

- How the endowment will directly support your nonprofit’s mission

- The long-term benefits it will deliver to the community you serve

- Stories of impact from current or past initiatives that inspire trust and confidence

Having a persuasive “case for support” can make or break your ability to attract major contributions. Always connect the endowment’s purpose directly back to your mission.

- Cultivate Major Donors

Building an endowment fund is often about engaging the right people. Major donors are key players in this effort. To effectively cultivate these donors:

- Identify those with a strong attachment to your organization and its mission.

- Schedule one-on-one conversations to explain the importance of the endowment.

- Offer naming opportunities and other recognition for their transformational gifts.

Did you know that over 80% of endowment contributions often come from less than 20% of donors? Creating meaningful relationships with these individuals can provide the foundation your fund needs to grow.

- Launch a Planned Giving Program

Planned giving, also known as legacy giving, is one of the most powerful tools for building your endowment fund. Encouraging supporters to leave a bequest to your organization in their will is an excellent way to start growing your assets.

To implement a successful planned giving program:

- Provide clear information on how supporters can leave a gift (e.g., through wills, trusts, or retirement accounts).

- Hold workshops or events to educate your donors about planned giving options.

- Promote the benefits, such as leaving a legacy that creates an enduring impact.

Remember, many donors aren’t aware they can contribute to your endowment via planned gifts. Raising awareness can unlock incredible opportunities.

- Establish a Matching Gift Campaign

Matching gift campaigns are a win-win for nonprofits and donors. They incentivize giving by allowing a donor’s contribution to be doubled (or even tripled) by matching funds from another donor, foundation, or corporation.

To run a successful campaign:

- Seek out a major donor or corporate partner willing to provide matching funds.

- Clearly communicate the urgency and impact of the match to your donor base via email, social media, and personal outreach.

- Set a clear timeline to encourage prompt action.

Matching campaigns create excitement among donors and can significantly boost your endowment contributions.

- Tap into Corporate Partnerships

Corporations can be valuable allies in building your endowment. Many companies have philanthropic goals that align with nonprofit missions, and they’re eager to support causes that resonate with their values and customer base.

Here’s how to approach corporate partners:

- Research companies whose values align with your nonprofit’s mission.

- Ask for sponsorships directed specifically toward the endowment fund.

- Highlight the public recognition and positive PR that come with their support.

Additionally, explore whether your corporate partners offer employee matching gift programs, which can further grow your donations.

- Educate and Engage Your Community

Your broader supporter base can help propel your endowment growth through smaller recurring contributions. Consider launching an annual campaign aimed at:

- Building awareness about what an endowment fund is and why it’s vital.

- Encouraging your community to contribute even modest amounts monthly.

- Sharing testimonials from beneficiaries who’ve seen tangible impacts thanks to donor support.

For example, a program like “$10 for the Future’’ invites supporters to pledge a manageable monthly amount toward ensuring your nonprofit’s stability.

- Work with Financial Experts

Building an endowment requires long-term investment strategies. Partnering with financial advisors or fund managers experienced in nonprofit endowments can help maximize your returns and ensure compliance with fiduciary responsibilities.

A well-managed fund signals to donors that their contributions are being stewarded wisely, fostering trust and encouraging additional gifts.

Final Thoughts

An endowment fund isn’t just an investment in your nonprofit’s financial stability; it’s an investment in your mission. By diversifying your fundraising efforts and engaging donors effectively, you can build an endowment fund that ensures you’ll continue making an impact far into the future.

Take Action Now

Are you ready to secure your nonprofit’s future? Start implementing these strategies today, and together, we can ensure your mission thrives for generations. For more expert tips and tools, contact us for one-on-one consultation.

Your mission deserves to last a lifetime. Make it happen.

Imagine leaving a legacy that continues to support your favorite cause long after you’re gone. Many people overlook the potential of their pension when considering charitable giving, yet it can be one of the most impactful ways to make a difference.

In this blog post, we’ll explore the possibility of making a charity the beneficiary of your pension and provide a guide for fundraisers and non-profit leaders to optimize this opportunity for their organizations.

The Power of Pension Beneficiaries

A pension plan can be a significant asset in your financial portfolio. But did you know that you can designate a charity as a beneficiary of your pension? This means that upon your death, the remaining funds in your pension can go directly to a cause you care deeply about.

Why Consider a Charity as a Beneficiary?

- Impactful Giving: Leaving a portion or all of your pension to charity can provide substantial support to the cause you believe in.

- Tax Benefits: In many jurisdictions, designating a charity as a beneficiary can offer favorable tax benefits, reducing the taxable amount of your estate.

- Legacy: Creating a lasting legacy that reflects your values and supports the organization’s mission.

- Simplicity: Updating your pension beneficiary designation is often a straightforward process that can be done without altering your will.

How to Designate a Charity as a Beneficiary

- Review Your Pension Plan

Not all pension plans allow for non-individual beneficiaries. The first step is to review your specific plan’s rules and guidelines. Contact your pension plan provider and confirm that you can name a charity as a beneficiary.

- Choose the Charity

Select a charity whose mission aligns with your values. Ensure the organization is a registered non-profit to qualify for potential tax benefits. This is also a great time for fundraisers and non-profit leaders to engage with potential donors, providing them with information about how their contributions will be used.

- Update Your Beneficiary Designation

Once you’ve confirmed the details with your pension provider, update your beneficiary designation form. Include the charity’s legal name and tax identification number to ensure there are no issues with the transfer of funds.

- Notify the Charity

Inform the charity of your decision. This can help build a relationship and ensure the organization can honor your wishes appropriately. Non-profit leaders should consider creating a designated contact for legacy gifts who can provide guidance and maintain communication with donors.

- Consult a Financial Advisor

Work with a financial advisor to understand the potential tax implications and benefits. They can provide tailored advice based on your financial situation and ensure your decision aligns with your overall estate planning strategy.

Case Studies and Testimonials

Real Impact Stories

Many non-profits have seen significant contributions through pension beneficiary designations. For example, Jane Doe left 50% of her pension to a local animal shelter, resulting in a $250,000 donation that funded new facilities and services for years.

Donor Testimonials

“I never realized my pension could support the causes I love. Knowing that my funds will create a lasting impact brings me immense peace of mind.” – Mark T., Donor

How Non-Profits Can Encourage Pension Beneficiary Designations

Educate Your Donors

Host informational sessions and provide resources about the benefits of designating a charity as a pension beneficiary. Use real-life examples and testimonials to illustrate the impact.

Simplify the Process

Provide clear, step-by-step guides and personalized assistance to potential donors. Make the process as seamless as possible to encourage more people to consider this giving option.

Build Relationships

Maintain ongoing communication with potential legacy donors. Show appreciation for their support and keep them updated on how their future contributions will make a difference.

Conclusion

Designating a charity as the beneficiary of your pension can be a powerful way to support your favorite cause and create a lasting legacy. It can offer significant benefits for both the donor and the recipient organization.

For fundraisers and non-profit leaders, understanding this option and communicating it effectively to potential donors can open a new avenue of support. By educating and simplifying the process, you can encourage more individuals to consider this impactful form of giving.

When it comes to planned giving, conventional wisdom often tells us to focus on senior donors—those who are over 65 and perhaps more settled in their finances. But is this approach outdated? Are we missing out on significant opportunities by not engaging younger donors in planned giving conversations? Let’s explore this question in depth.

Are We Wasting Time Pursuing Planned Gifts with Younger Donors?

The Traditional Focus on Senior Donors

Historically, planned gifts have been the domain of older donors. This demographic has had more time to accumulate wealth and typically starts thinking about estate planning as they approach retirement. Organizations have long targeted donors over 65 for these reasons, assuming that younger donors are either not interested or not financially prepared to make such commitments.

Why Younger Donors Should be Part of the Conversation

But times are changing, and so should our approach. Here’s why younger donors are worth discussing planned gifts with:

- Long-term Relationships

Engaging younger donors in planned giving conversations can lead to lasting relationships. These individuals may not have significant assets now, but fostering a relationship early ensures that your organization stays top-of-mind as they grow their wealth.

- Changing Attitudes Toward Philanthropy

Younger generations—Millennials and Gen X—are showing an increasing interest in philanthropy. A 2018 study by the Case Foundation found that 84% of Millennials made charitable donations, and 52% said they would be interested in making a planned gift. This signals a shift in how younger people view their role in supporting causes they care about.

- Financial Planning Starts Early

Today, financial planning often begins at a much younger age. With the rise of financial literacy programs and tools, many people in their 30s and 40s are already considering their long-term financial goals, including charitable giving.

Real-life Stories and Testimonials

Consider the story of Emma, a 45-year-old tech entrepreneur who started her estate planning early. She was approached by a nonprofit she supported and was delighted to discuss how she could contribute through a planned gift. “I appreciated that they saw me as a partner in their mission, not just a donor,” Emma says. Her planned gift has now become one of the organization’s most significant future contributions.

Statistics to Consider

According to a report by Giving USA, planned gifts from younger donors could represent a substantial portion of future philanthropy. Engaging them now can ensure your organization benefits in the long run.

- Interest in Philanthropy:

A study by U.S. Trust noted that 67% of Millennials are interested in discussing planned giving as part of their financial planning.

Overcoming Common Objections

“They Don’t Have Enough Wealth Yet”

While it’s true that younger donors may not have accumulated significant wealth, discussing planned gifts is about planting seeds. It’s about making them aware of the options available and how they can contribute meaningfully over time.

“They’re Not Thinking About Estate Planning”

In today’s fast-paced world, younger generations are more proactive about financial planning. Many are open to learning about different ways to support causes they care about, including through planned giving.

How to Start the Conversation

Educate and Inform

Provide resources that help younger donors understand what planned giving is and how it can benefit both them and your organization. Use blogs, webinars, and one-on-one meetings to share this information.

Highlight Flexibility

Make it clear that planned gifts can be tailored to fit their current financial situation and can be adjusted as circumstances change.

Offer Incentives

Consider offering recognition or benefits that make the idea of planned giving more appealing to younger donors. This could include exclusive events, insider updates, or naming opportunities.

Conclusion

Are younger donors worth discussing planned gifts with? Absolutely. By engaging donors under 65 in planned giving conversations, you’re not just securing future contributions—you’re building lasting relationships and fostering a culture of philanthropy that will benefit your organization for years to come.

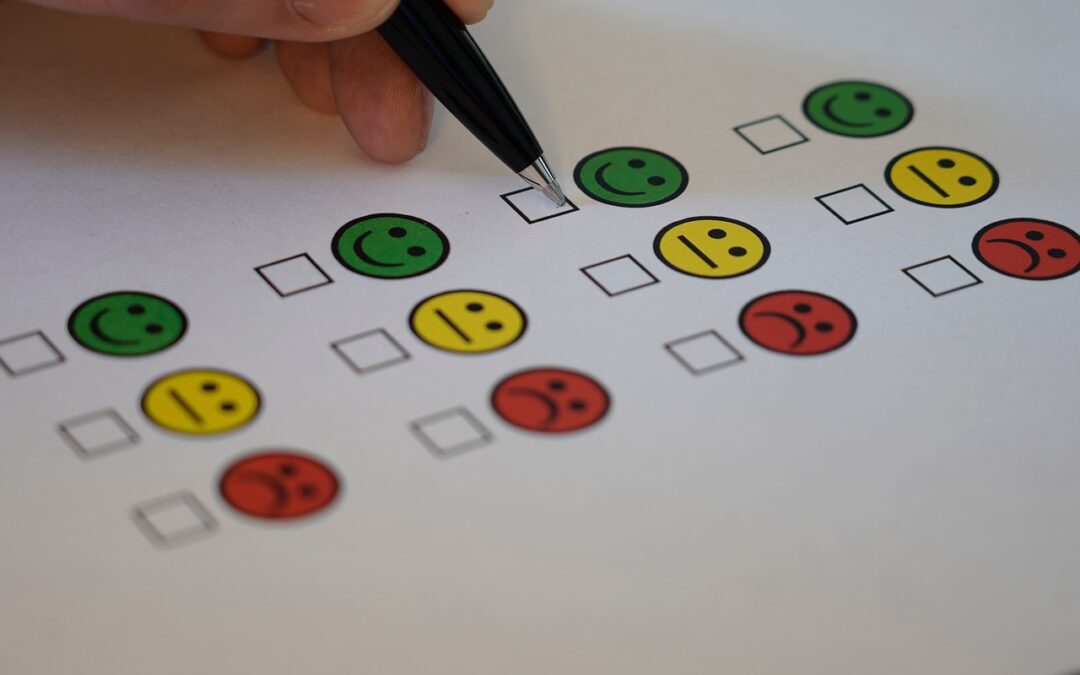

In the world of fundraising, a well-executed planned giving survey can be a game-changer. It provides valuable insights into your donor base, helping you tailor your strategies and maximize engagement. Yet, many nonprofits overlook this powerful tool. Let’s explore how conducting an effective planned giving survey can benefit your organization and how to implement one successfully.

Why Planned Giving Surveys Matter

Planned giving surveys play a crucial role in understanding donor intentions and preferences. They help you identify potential planned giving donors, understand their motivations, and effectively communicate the impact of their contributions. Here are some compelling reasons to prioritize planned giving surveys:

- Identify Potential Donors: According to a study by the National Association of Charitable Gift Planners, 31% of donors are more likely to consider planned giving if they are approached in a personalized manner.

- Tailor Your Approach: By understanding the motivations behind planned giving, you can craft messages and campaigns that resonate with your donors.

- Build Long-Term Relationships: Surveys show that engaging donors in conversations about their giving preferences increases loyalty and long-term support.

Steps to Conduct an Effective Planned Giving Survey

- Define Clear Objectives

Before you design your survey, identify what you hope to achieve. Are you looking to gauge overall interest in planned giving, or are you trying to identify specific types of planned gifts? Setting clear objectives will help you craft questions that yield actionable insights.

- Craft Thoughtful Questions

The quality of your questions will determine the usefulness of your survey. Here are some tips for creating effective questions:

- Be Specific: Instead of asking, “Are you interested in planned giving?” ask, “Which types of planned gifts are you interested in learning more about?”

- Use a Mix of Question Types: Include multiple-choice, rating scales, and open-ended questions to capture a range of data.

- Keep It Short: Aim for brevity to respect your donors’ time. A survey with 10-15 well-crafted questions should suffice.

- Segment Your Audience

Not all donors are the same, and your survey should reflect that. Segment your audience based on factors such as donation history, age, and engagement level. This allows you to tailor questions and follow-up communications more effectively.

- Offer Incentives

Encourage participation by offering incentives. This could be a small gift, exclusive content, or an entry into a raffle. Ensure that the incentive aligns with your organization’s values and the interests of your donors.

- Utilize Digital Tools

Leverage digital survey tools like SurveyMonkey, Google Forms, or Typeform to streamline the process. These platforms offer templates, easy distribution, and data analysis features that can save you time and effort.

- Analyze and Act on the Data

Once you’ve collected responses, analyze the data to identify trends and insights. Look for patterns in donor preferences and motivations. Use this information to refine your planned giving strategies and tailor your communications.

- Follow Up with Respondents

Show appreciation for your donors’ time and input by following up with personalized thank-you messages. Share key findings from the survey and outline how you plan to act on the feedback. This builds trust and demonstrates that you value their opinions.

Case Study: Successful Planned Giving Survey

One nonprofit that excels in utilizing planned giving surveys is Helping Hands Foundation. By segmenting their audience and crafting targeted questions, they identified 150 potential planned giving donors within three months. Their follow-up communications highlighted specific donor stories and the impact of planned gifts, resulting in a 20% increase in planned giving commitments.

Conclusion

Conducting effective planned giving surveys is a strategic move that can significantly boost your fundraising efforts. By understanding your donors’ preferences and motivations, you can create targeted campaigns that resonate and inspire long-term support.

By taking these steps, you’ll be well on your way to unlocking the full potential of planned giving for your organization. Start today and watch your donor relationships—and your fundraising results—flourish.