Do We Need to Be Registered in All 50 States to Offer Charitable Gift Annuities (CGAs)?

Do We Need to Be Registered in All 50 States to Offer Charitable Gift Annuities (CGAs)?

Charitable gift annuities (CGAs) are one of the most compelling life income gift options available for nonprofits and fundraisers. They provide a way for donors to support their favorite causes while also securing a steady income for life, making them an attractive option for both donors and organizations. However, as the popularity of CGAs grows, many nonprofit professionals have one pressing question:

Do we really need to be registered in all 50 states to offer CGAs?

The short answer is no. But as with most things, the nuances matter. Understanding what’s legally required and where your organization must focus its efforts is critical to maintaining compliance and building a successful CGA program.

What Are the Legal Requirements for Offering CGAs?

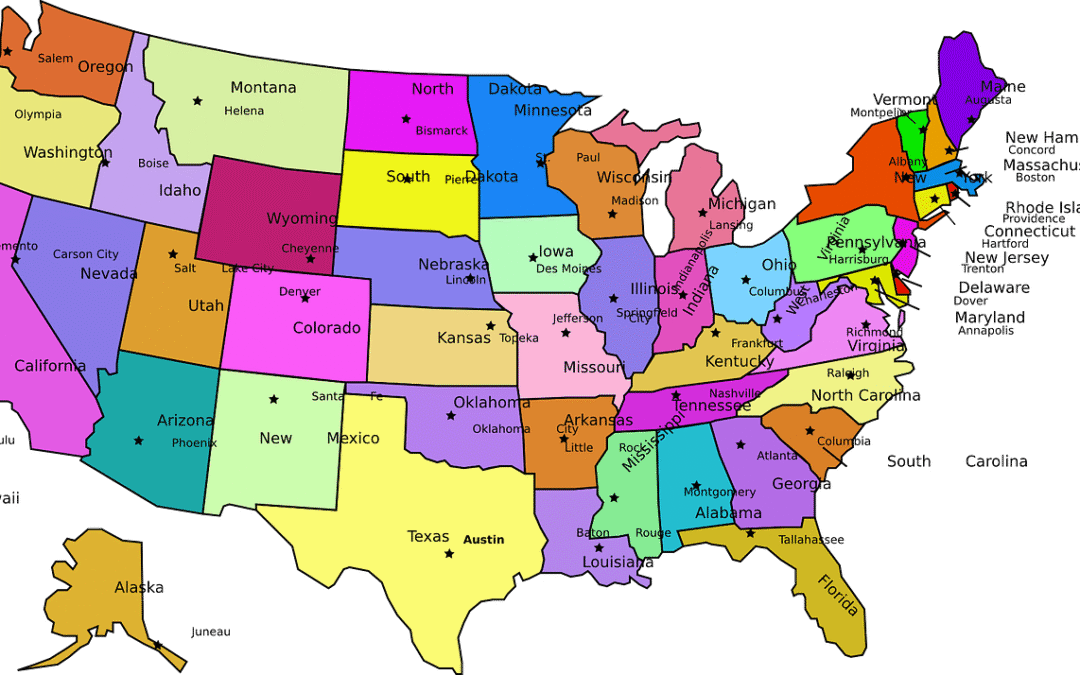

When it comes to offering charitable gift annuities, regulations vary significantly by state. Some states require nonprofits to register or obtain specific licensing to offer CGAs, while others have no such requirements. Here’s a quick breakdown:

- Registration Required States

Many states require nonprofits to formally register before offering CGAs to residents. These states often mandate strict compliance measures, such as maintaining a reserve fund or providing annual financial reports. For example:

- California requires nonprofits to meet specific reserve requirements and provide filings to the Department of Insurance.

- New York has stringent regulations, including reserving a portion of assets to back annuity agreements and securing a license to issue CGAs.

- Exemption States

A handful of states exempt nonprofits from registering for CGAs, typically if they meet certain conditions, such as being a 501(c)(3) organization with no ongoing operations within the state.

- No Registration Required States

Some states, like Indiana and Montana, do not require nonprofits to register or notify the state to issue CGAs to residents.

Key Takeaway

You don’t need to register in all 50 states to offer CGAs, but you do need to understand the specific rules for the states where your donors reside.

How to Determine Where to Register

Start by reviewing where your donors live or where you anticipate the most interest in CGAs. If your donor base is concentrated in a few states, focus on registering in those states first. However, if your donor pool spans multiple states, here are some actionable steps to ensure compliance:

- Research State Regulations

Visit your state’s charitable solicitation office or Department of Insurance website to understand its requirements. For heavily regulated states, such as California, New York, or New Jersey, you may need to allocate more time and resources.

- Work With Legal or Compliance Experts

If you’re unsure about the specific regulations, consult with a legal expert who specializes in nonprofits or charitable giving. They can offer guidance on navigating the complexities of state laws.

- Develop a Donor-Centric Communication Plan

Be transparent with your donors if regulations in their state limit your ability to offer CGAs. Consider alternative ways they can support your cause with other types of life income gifts.

Why State-by-State Registration Matters

Adhering to state regulations isn’t just about avoiding fines or legal consequences; it’s about building trust with your donors. Operating in compliance demonstrates that you value transparency and accountability, which are key drivers for sustaining donor relationships and growing your CGA program.

Additionally, remaining compliant can help safeguard your nonprofit’s financial health. Some states impose heavy penalties for non-compliance, and the reputational risk of failing to meet legal obligations can harm donor confidence.

Alternatives to Consider If Registration Feels Overwhelming

For nonprofits that may not have the resources to register in multiple states, consider these alternatives:

- Partner with a charity that is already licensed to offer CGAs in those states. These collaborations allow you to expand your reach without taking on the administrative burden of multi-state registration. Check out https://charitablesolutionsllc.com/.

- Explore other life income gifts, such as charitable remainder trusts (CRTs) or donor-advised funds (DAFs), which may offer fewer regulatory requirements while still engaging donors who value planned giving.

- Limit your CGA offerings to states where your organization is already registered or exempt to reduce compliance headaches.

Streamline Your Fundraising Success

Charitable gift annuities are an incredible tool for engaging donors and securing long-term support for your nonprofit’s mission. While navigating state regulations can feel daunting, focusing on compliance in key donor states can help you launch a successful program without overextending your resources.

Want to learn more? Reach out to our team today for tailored guidance on launching or refining your CGA program. We’re here to help ensure your organization’s success while maintaining full compliance with state laws.

With the right strategy and resources, your nonprofit can leverage CGAs to build stronger relationships, provide value to your donors, and amplify your fundraising impact